Interdigital ($IDCC): Connecting the world

An under discover wireless technology company

This post was inspired by an episode of Business Breakdown: InterDigital: Setting Wireless Standard. I think Jenny Wallace, the co-founder and CIO of Summit Street Capital Management done a great job in dissecting the company and get me interested to learn about it.

Connecting the world

Ever wonder how you can call your friends anyway in the world without any problems? It is enabled by some of the best cellular/wireless technology company in the world. As Acquired.com mentioned, these companies are arguably as impressive as Nvidia in revolutionizing the respective industry.

Qualcomm (Quality communication) is probably the most well known in the industry but actually, there is another smaller company that is lesser known which is also equally important (contributed from 2G - 6G technology) and I would want to share with my subscribers - Interdigital ($IDCC).

Company: Interdigital

Ticker: $IDCC, listed in US

Industry: Communication, Research & Development company

Market capitalization: $3bil

Investment thesis

Interdigital is one of the most important companies in terms of contribution to cellular and wireless technology but still trading under the radar. The most comparative peer is the industry leader - Qualcomm. However, instead of designing their own chips for wireless technology, it is the only listed pure play R&D company in the wireless and video technology industry. (please let me know if there is any others)

I think it is pretty self explanatory that a patent company is an asset light and exceptionally high margin business (normalise margin at 40%-50% net margin). It is also protected from high barriers of entry due to regulation. However, the revenue and margin can be volatile due to the nature of the industry (lawsuit driven). As a result, it is mostly avoided by institutional investors.

This report will be a deep dive into the wireless and video technology industry and how IDCC sustains its competitive advantage against its competitors. On top of that, I will also discuss its capital allocation and potential risks on the company to decide whether to invest into this company?

Industry primer

Before proceeding to understand the company, we have to understand why there is a need for cellular and wireless standards in the first place.

Sources: Spectrum Management For Wireless Network by STL tech

First of all, we need to know that the wireless spectrum is a fixed and finite resource. Only a certain range of radio frequencies exist (as shown above) and once a “slice” of the spectrum has been allocated, its use by others is limited. It is usually auctioned off by respective governments to its domestic wireless carriers (ie: AT&T, T-mobile,etc in US context).

Thus, with a finite amount of differentiated quality spectrum, there will be an increasing demand for technology to fully utilize their spectrum. When there are many players involved, it is crucial to have standards to ensure compatibility and efficiency.

So, what kind of problem do these technology companies try to solve? Basically, technology companies try to optimize these 3 things: encoding → transmitting → decoding between a device to the telco towers and vice versa to ensure better & cheaper connectivity for communication (ie: higher speeds, lower latency, interoperability, etc). Thus, with every generation of connectivity (2G,3G,4G,5G), the technology got better and resulted in a more efficient use of the finite resources.

Then, the next step is to understand the industry ecosystem. This is because each of them needs to agree on a certain standard (known as standard essential patents-SEPs) before the implementation of a new generation of connectivity. It usually takes about 5 years before wide implementation. Thus, it is crucial that these new technologies appeal to them. In short, there are mainly 4 key and 3 supporting players in the ecosystem as shown below:

Note: It is an example of the US landscape (might differ by countries)

To ensure interoperability for communication internationally, standard development organizations (SDOs) were formed by respective countries to standardize the communication standards. (usually, it is mandatory for most countries under the global GSM standard by ETSI except the US) As a result, for the US context, it is purely decided by the local players in the ecosystem.

For example, when Qualcomm introduced CDMA (Code division multiple access), a technology that is crucial for utilising the spectrum, it was quickly adopted by the wireless carriers due its cost efficiencies despite not being the standards (estimated to be 3-5x cheaper than its existing technology). Since they built up the infrastructure, the rest of the players have to follow in order to use their services or face injunction or lawsuits by the patent companies.

Thus, it is typical that these technology companies have a tendency to appeal to the wireless carriers (with low to zero licensing fee) and once it is used as a standard, they will milk it by licensing the technology to hardware manufacturers. (they have no choice but to accept)

Introduction

So, where does Interdigital (IDCC) fit in the ecosystem? It is basically a pure R&D and licensing company. All it does is to research new technology for communication/video and patent it for others to use. A quick brief in its history helps to understand the company better.

It was originally founded by Sherwin Seligsohn to gain access to communicate with his broker while working in remote areas. Thus, he invented a portable data machine to provide secure communication. Eventually, it was used by white House for the exact purpose.

However, the turning point was when they were engaged by Nokia in the late 90s to co-develop a technology for 2G to 3G breakthrough. (time division duplexing, which is a way of splitting bandwidth), it realized that it is far better to be a developer for the standards-based technology than a product company. Thus, this is how IDCC has transformed into an independent R&D company.

Business model

Its revenue is mainly derived from signing a fixed long term contract (a small portion coming from variable royalty agreement) with its licensee and typically lasts for 5-7 years. IDCC managed to renew 99% of its expired contract (total contract value is about $2.5bil) as their technology is part of the standard. The customers can complain about the royalty but they can’t avoid it as long as they said they are aligned to the standard.

As for pricing, it is based on the principle of fair, reasonable, and non-discriminatory (FRAND). It means that it will be based on bilateral agreements but sometimes, the negotiation will go through court (for those that are not paying but using their technology) or arbitration (using an independent party to decide the fair amount like Samsung)

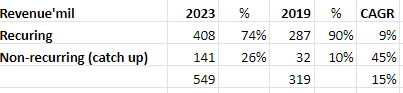

Sources: TQI calculation

Another interesting aspect of their revenue is when the company signs a new license agreement with existing or new customers, there will be a “catch up” revenue (to compensate them on previous unlicensed patents) . This catch up revenue is non-recurring but the beauty is that it is a 100% gross margin contract. It can be considered as an optionality. As a result, this unpredictability has fended off some potential investors. (varies based on their lawsuit status)

(If you ever wonder why during this period (2018-2019). the company seems to suffer from low margin and reduction in revenue, it is due to there is a change in revenue recognition from ASC 605 to ASC 606. Revenue only can be recognized based on number of devices sold instead of overtime at a straight line basis)

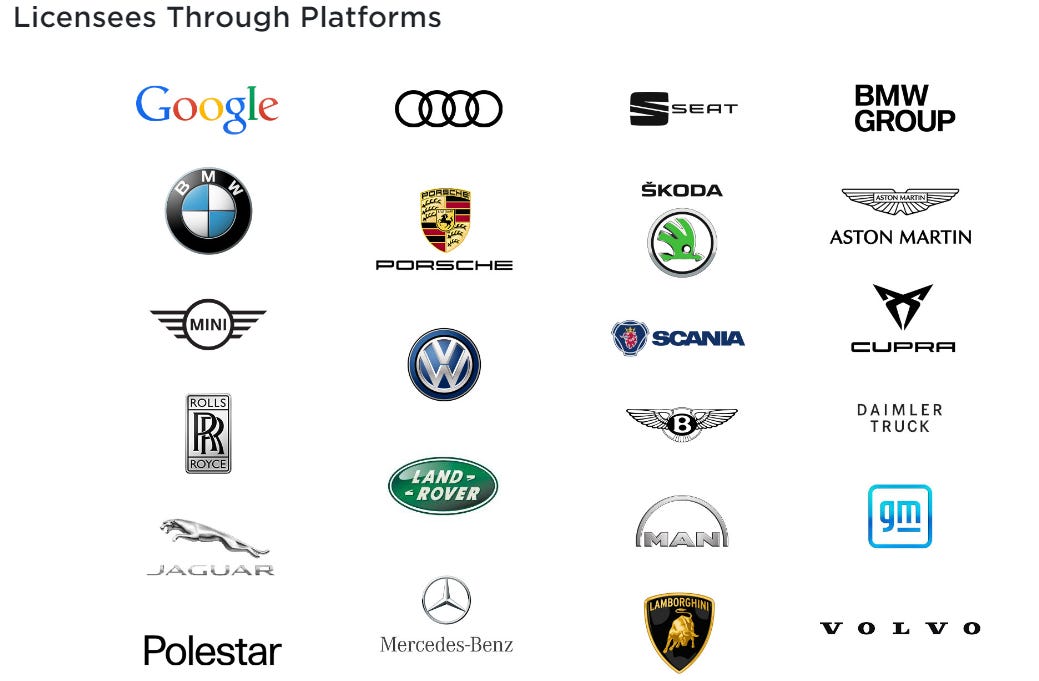

Its revenue contribution can generally be segmented into 85% smartphones (smartphone, tablet, base station), 15% consumer electronics and IOT and automobiles (TV,laptop, gaming consoles, set-top boxes, streaming devices & connected automobiles). However, IDCC notes that they will further diversify their revenue to CE & IOT to 25%. It is due to their effort of consistently building an expanding patent portfolio from wireless to video technology.

Total addressable market

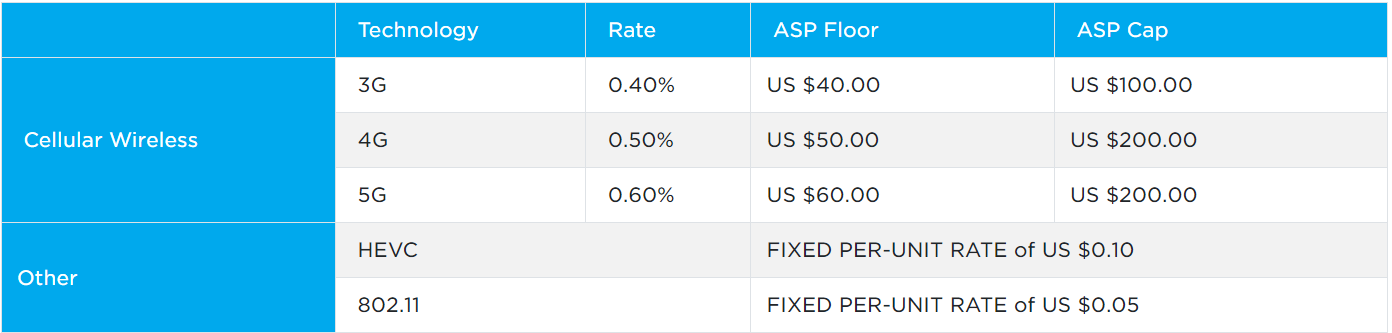

The addressable market is much harder to estimate as it is boiled down to bilateral discussion. However, the company does share their rates for a SEP license for handsets as below:

Sources: Interdigital rate rate disclosure (apply to mobile only)

An example given by them: “On a $500 smartphone that implements 3G and 4G standards, as well as 802.11 and HEVC video technologies, our rate per handset would total $1.15 (i.e., ($200 * 0.50%) + $0.10 + $0.05). “

Of course, this is just a guide and the royalty per handset can be lower depending on the company size. If we look at the latest contract renewed between Apple and IDCC (about $1bil for 7 years), by taking the license fee per year / smartphone shipment, it worked out to be about 60 cents per Iphone in 2023. (a 15% increase vs previous contract)

If we were to take the above as a benchmark excluding their existing customers, the remaining opportunity should work out to the range from $255mil to $675mil annually. (assuming additional 500mil mobile adopted all its patents for phone price ranging from >60 to >200) So, it is safe to conclude that IDCC is still able to at least double its mobile revenue in short to medium terms if they are able to capture the remaining market.

The low hanging fruit would be the remaining 40-50% of the handset manufacturers that have yet to pay for their licenses especially in countries with weak enforcement on patent rights like China. The company is currently in lawsuit with OPPO and Lenovo to determine the fair royalty amount.

As for consumer electronics and IOT, it is yet another large market but its addressable market is again very much dependent on their payment structure. Traditionally, there is little exposure in these areas due to minimal usage of their technology.

However, going forward, I believe that they should be able to grow the pie given the emergence of smart consumer electronics like wireless TV, connected cars, smart gadgets, etc. As per their annual report, it is estimated that there are around 400mil smart gadgets sold annually that fit into this category. If they are able to monetise it at around $0.10 to $0.50 cent, that should work out to be around $40 to $200mil additional revenue for them.

A good example is Avanci, a licensing platform founded by a few patent companies including IDCC to monetize their 4G and 5G patent portfolio to automobile companies. Both Mercedes Benz and BMW licensed their technology to embrace their strategy of being a smart car manufacturer. The number of connected cars using 4G technology are increasing rapidly with an estimation of 15% growth rate as per its CEO.

Lastly, the biggest optionality for IDCC will be licensing their video technology (ie:HEVC/H.265, crucial for high resolution streaming) to video cloud service providers like streaming companies (Netflix, Disney +, HBO,etc). Currently, there is no contribution for this segment but if they can monetise it based on the estimated addressable market ($350bil), even with a small take rate like 0.1% would result in additional $350mil revenue.

However, It can be hard to monetise due to the development of open source technology by Alliance for Open Media (formed by google, Netflix,etc) to encourage wide adoption. Nokia is leading a lawsuit against them and IDCC might follow their footsteps if they successfully win a deal with them.

Competition

As the wireless technology has more use cases & monetisation possibilities (due to the rapid rise in connected devices other than mobile phones), it has attracted more interest within the industry. There are more companies trying to file for their own Standard-Essential Patents (SEP).

However, it is not going to be easy as the leaders are constantly throwing millions of dollars to develop and influence the direction of the essential patents. Besides, even if the new player's technology is superior, the incumbent has been in deep collaboration with the existing players (wireless carrier, network equipment provider, etc) that it becomes very difficult to convince them to change due to issues like interoperability and switching cost.

A good example is the wireless carrier where they spent billions of dollars building base stations and once they adopted the standards, they rarely changed because it takes time for them to recoup their investment. Even if the technology is superior, the cost of change will easily outweigh the benefit.

As a result, most of the lawsuits brought against them are typically related to Antitrust or monopolistic behaviour. Take for example the case between Lenovo, Motorola and IDCC, as per Essential Patent LLC:

“they complain that the standard faces no meaningful competition and has been implemented by the overwhelming majority of the telecommunications industry. Thus cellular devices must comply with the promulgated standards to be commercially viable and implementers become “locked in” to that standardized technology.”

Competitive advantages

Interoperability & compatibility

For context, it is not difficult to join the standard development organization like 3GPP, IEEE, etc but there is one problem when it comes to setting a new standard especially for the core technology, that is it requires interoperability between generations. As such, it is very difficult to exclude incumbents from the equation.

The gist is summarised well as follow in their website:

“In wireless, new standards are built on the shoulders of older generations. Not every element of a new standard is entirely new. As a result, many technologies are carried over from one generation to the next, resulting in a patent footprint on a device that builds as generations advance and devices maintain backward compatibility.”

As a result, as long as the incumbents continue to plow back their resources to the next generation technology, their patent families will remain the biggest among all its competitors. Qualcomm remains as the leader and IDCC is a #3 or #4 providers of essential IP depending on the generations.

For example, there are more than 130 companies participating in 5G development but the top 10 (including Qualcomm, Samsung & IDCC) account for 3 / 4 of the 5G patent families. It is similar across different generations (2G,3G,4G) with the top players dominating the SEPs for wireless & cellular industry.

Strategic positioning

IDCC is also well positioned to win due to their strategic position. As an independent player, there is no conflict of interest and its technology (assuming on par with the best technology) has a better opportunity to be adopted as part of the standard. (it needed support from the industry players)

Since most of its competitors are also manufacturers (internal research department), IDCC stands out in this aspect. Their customers don't have to worry about “funding” their competitors to compete with them. It reminds me of TSMC and they are currently the most successful fab manufacturer in the world as they are neutral and only focus on producing the best chips for its customers.

Of course, it has to be competitive as well but since they are a pure R&D company, they should be able to leverage their increasing scale (in terms of human resources) to compete effectively. For example, IDCC consistently invests up to 40% of its sales into R&D.

Although it is small in absolute terms against competitors like Qualcomm at almost $9bil (including its chip business), it is still significant for a pure play R&D player. As a result, its portfolio of patents are increasing at a very rapid rate reaching >30,000. (55% wireless, 25% video, 10% implementation, 6% DTV and 4% Broadcast & home network) In addition, as per LexisNexis, IDCC quality for its 5G patent is also ranked highly among its competitors. (not only based on number of patents)

One potential consideration would be will be they acquired? I think it is very unlikely due to the conflict of interest argument stated above. If any players were to acquire them, it will be either flag as antitrust (Qualcomm/Nokia) or being blocked for national interest. (MediaTek/Broadcom)

Resources cornering

Due to it being an independent player, it became a magnet to attract inventors/talents. Since it is a highly profitable business, it could afford to pay and hire the best resources within the industry. For example, about ninety percent of the company’s personnel are inventors, recruited from top universities and Ph.D. programs around the world.

Another important advantage when comparing to larger companies would be there is no bureaucracy and restriction on collaboration with any parties (For example, Samsung wouldn’t work with Qualcomm), it is more appealing to the best talents. As a result, we can see that almost half of the executive team came from qualcomm despite their lead in the wireless industry.

As per an article by Forbes, in its CEO words:

“InterDigital’s reputation allows it to attract the brightest engineers in the world; these engineers are then placed on collaborative teams, mentored, and given freedom to create and innovate.

Sources: 2023 Investor presentation

Lastly, if we were to look at the number of employees holding leadership positions within various standard setting bodies, it is >100 people. This is not only a testament of the quality of its employees, but also indicates the possible influence of their employees within these bodies thereby giving them an edge over its competitors. (ie: familiar with the standard setting procedure, close relationship with the infrastructure players, etc)

Management

William J. Merritt has been leading IDCC for 16 years and decided to step down and passed the baton to Liren Chen, who was a senior Vice President and Global Head of IP, Legal Counsel for Qualcomm in 2021. I do think that Liren is potentially a good candidate to lead the company due to his previous experience with Qualcomm.

Some interesting takeaways is that he is also a successful innovator and co-inventor on more than 120 patents worldwide. I believe that only a true inventor understands the meaning of patents and will try their best to protect them. That being said, its management team is also seasoned with highly experienced technical engineers.

With this transition, I think that IDCC might take a more aggressive approach due to the legal background of its CEO. They are currently setting up offices in China, Beijing to go after the low hanging fruit like OPPO, Transsion, etc (ie: recent lawsuit against OPPO and Lenovo) as well as other segments such as connected devices and video.

(Note: an interesting history about IDCC was that during 2013, IDCC was investigated under the anti-monopoly in China and its executives refused to meet its agency for fears to be arrested as reported by Reuters)

Incentive and ownership

When we look at its cost breakdown, there is no doubt that staff costs represent the biggest portion of its total cost due to the nature of the business. Therefore, it is crucial to determine if the management is properly incentivised to do the right things for the long term prospect of the company.

From their compensation structure, it is segmented into both short term and long term. As for short term reward (25%), it is based on their revenue growth (60%), patent growth(30%) and Diversify, Equity and Inclusion (10%). The patent growth metric is definitely something that we need to look out for as the CEO might be focusing on quantity instead of quality of its patents.

As for long term reward (75%), it is mainly looking at time (50%, vest over 3 years) and performance based share awards (50%) to align their long term interest to shareholders. The performance award is mainly based on the EBITDA of the company & consumer electronics revenue.

Since it is a professionally managed firm, it is not surprising to note the low ownership at 2.3% by the management. I think that the top management is properly incentivised but the bar for performance is pretty low for them.

Capital allocation

It is easy to conclude that the business is flushed with free cash flow and expanding cash reserves but it can’t be fully distributed to its shareholders due to the nature of their business. This is because it has to show to its potential/existing customers that it has sufficient fire power to withstand the long and tough legal battle over their patents. (hard for other pure R&D to compete due to their strong balance sheet)

As a result, the strong balance sheet (net cash of about $400mil) is a good signalling effect to them that IDCC is able to go through a series of legal battles to recoup the payment that they are entitled to. The latest big win for IDCC was the legal case against Lenovo and they successfully won the legal case and resulted in a one-off payment of about $180mil.

However, as IDCC continues to grow and generate more free cash flow, there is less to be swept for this purpose and the excess cash can be distributed back to its shareholders. A good indication is that over the last 10 years, its share counts have reduced by more than 46% which is a good sign of good capital allocation. On top of that, there is a small 1.5% dividend yield to boost shareholder return. (about an average of 6.1% of yield annually)

The company does occasionally acquire companies but it is mainly for their portfolio expansion to reduce their concentration risk. For example, in 2016, IDCC acquired Technicolor, a R&D department of it, to venture into video technology. Its contribution remains small due to open sources competition but it can be a big growth drivers for the business.

Risks & considerations

Patent troll (Innovation risk)

In general, the most obvious criticism for a patent company is their lack of innovation. They are just holding crucial patents and milking it without making much contribution to progress the industry as a whole. It is true to a certain extent but when the technology is moving at a meteoric speed, older technology will be eliminated pretty quickly if they stop innovating.

It is certainly an important consideration if IDCC is lacking behind and only feeding on the older technologies. The assessment is that they are far ahead in terms of their innovation and they are currently looking at 6G technology. It is good to know that they are one of the leading contributors to 5G technology as noted by LexisNexis, an independent patent assessment company.

Patent regime

Patent protection has always been the most crucial barrier for the company and if there is any change in the patent regime such as removing the patents protection, it is going to be a major threat to the company as everyone can use its patent without paying them.

Lobbyists have been consistently trying to argue that standards should be set by non-profit organizations and government bodies. This is because when profit organizations are involved, they will collude to set a standard that benefits the existing players and thereby raises the barrier to entry.

Besides, according to the Patent lawyer, if we look at the recent verdict between Lenovo and IDCC, it can be seen that the outcome is leaning slightly towards the licensee in terms of financial (requested $337mil but only received $180mil) but it still validates that their technology is essential. In this case, the impact might be lower royalty per device in the future.

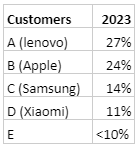

Customer concentration

Sources: 2023 Annual report

Customer concentration is a huge risk for IDCC as they might lose some of their negotiation power when these customers become a bigger part of the wireless communication industry. For example, Samsung, Apple and Xiaomi make up about 50% of worldwide smartphone shipment in 2023 and it will reduce their opportunities to license.

Political considerations

Based on the book, Wireless War, the author argued that Huaweri is actually leading the 5G technology and if they are able to set most of the standard of communication, it can be seen as a threat for national security purposes for the US. As a result, their technology was banned by multiple countries.

It is not difficult to conclude that these standard essential patent holders aren’t invincible but just like the semiconductor industry, since it is a highly sensitive technology and every country is incentivized to build its own technology. As a result, as a US based company, IDCC has benefited from CHIPS Act funding. This funding will help ensure that the U.S. remains at the forefront of wireless innovation.

Conclusion

IDCC is one of the leading technology companies in contributing to the wireless and video industry. The company has been trading under the radar due to the volatility of its revenue. (rely on lawsuit) However, its technology is crucial in enabling communication as it owns a significant portion of the standard essential patents (SEPs) in its portfolio.

The industry size is generally difficult to estimate as it is mainly driven by bilateral agreements but there are some low hanging fruit which as long as any companies claim in compliance with the standards, they are required to pay for the royalty fees. My estimation is that if there were to go after it (through legal or arbitration), it should be at least 2x its current revenue.

Next, it is not difficult to conclude that they have an edge to protect their “castle”. The most obvious one would be the barrier of entry such as patents, interoperability and switching cost. For me, the switching cost is probably the hardest to break into unless the benefit far outweighs the cost. Infrastructure players are likely to be the most important decider in this matter.

On top of that, they are also positioned strategically when it comes to deciding the standards. By being independent players, they could avoid the conflict of interest as the other players might not want to fund their competitors. Besides, with their increasing scale and resources, they could afford to reinvest more to create more as well as better quality patents and go after potential licensees.

In addition, they are also a magnet to attract talents due to the freedom and lack of bureaucracy. As a result, since it attracts high quality employees, more than 1/4 of their staff are leading in various standard development bodies which should give them the edge to at least influence the direction of the results.

As for the management, it is mostly coming from qualcomm, the industry leaders in creating wireless patents. I think that the management is both calibre and competent in running the company as evidenced by their ability to both successfully renew the expired contract and go after the low hanging fruits. Besides, their capital allocation has been decent as evidenced by the drastic drop in share count (46% in 10 years) and dividends.

Of course, there are some risks such as customer concentration (losing bargaining power), shifting of patent regime (losing patent protection), lack of innovation (lacking behind its peers), etc. The shift from 4G to 5G has actually created a breakthrough for new entrants like Huawei but due to political consideration, the company technology was actually banned. It shows that great technology does not equal mass adoption.

In conclusion, just by assessing the recurring revenue and its potential margin by comparing to Nokia’s technology (a good proxy for their margin and growth potential), it seems to be trading at a reasonable price. (Nokia patent division currently has about $1.2bil sales and 70% OPM. Assuming IDCC can grow to $0.8bil and $320mil net profit (40%), it implies that we can buy the company at 10 P/E ) Anything above that will be an optionality to the company. Therefore, it is a buy at the moment.

Note: The company is almost at the end of finalising its contract renewal (except Oppo, Vivo, samsung) & lawsuits and subsequently, it will be stable with minimal growth until the next cycle of renewal.

Disclaimer: I might have position in the company mentioned and receive no fees for writing the post. I am not affiliated or have any role with the company. This post is just for educational purpose and it is not an advice to buy or sell the stocks. Invest at your own discretion.

Resources

The Complete History & Strategy of Qualcomm by Acquired.com

InterDigital: Setting Wireless Standards by Business breakdown

InterDigital’s Story: Fostering Industry Solutions and Profiting from its Growth by William Merritt

Various court cases between IDCC and its lawsuits by Essential Patent LLC

Source: Company website - Licensees