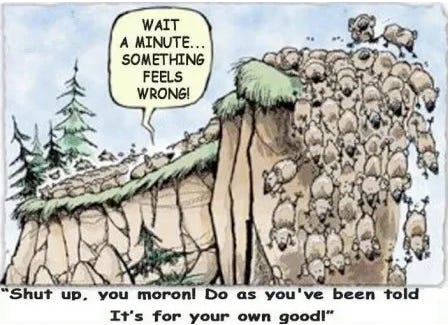

Lemming effects

The side effect of group thinking

Sources: The lemming effect by Bruce

In a world where trends and movements dominate, the lemming effect serves as a cautionary tale about the dangers of blindly following the crowd. Named after the misconception that lemmings plunge off cliffs en masse, this phenomenon highlights how individuals can make irrational decisions simply because others are doing the same.

I won’t delve into Bitcoin here, as it’s already been analyzed from countless angles. Instead, my focus today is on how corporations often fall into the same trap—whether consciously or not—of ignoring lessons from history or repeating avoidable mistakes.

Dot.com bubble

This is actually a very common phenomena throughout the history of corporate and let me cite an example from the book - Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last 25 Years by Paul B. Carroll.

The most well known of this phenomena will be the dot.com bubble during the late 90s. Telecommunications companies are rushing to put fiber in the ground hoping to beat other by locking up traffic. Companies spending ten of billions on their effort in order to catch the next big waves of Internet.

We know how it ends right? Badly. Telecom companies has to write-off billions of dollar in their fiber investment and most of them went out of business. It is true that Internet revolutionized the world but these companies didn’t factor into account how technology (specifically processor) has improved so much that it can route traffic efficiently without additional fibers.

The age of AI

Sound familiar? It bears striking similarities to the current wave of AI investments by leading technology companies. These firms have unveiled massive investment plans, with hundreds of billions poised to flow into AI initiatives. According to Paul, "lemming syndrome" often emerges in two key scenarios:

“One is when many companies face high uncertainty about the market or technology. Companies tend to follow the market leader so as not to be left out because they think they might know something that they don’t know. ‘“ Paul

A prime example is Microsoft’s announcement of its multi-billion-dollar plan to build data centers dedicated to leasing capacity for AI startups to train large language models (LLMs). This move followed the groundbreaking debut of ChatGPT, which stunned the world with its capabilities. Now, everyone is rushing to board the same train, creating a windfall for Nvidia, whose unrivaled GPU chips have become the backbone of this AI revolution.

“The other situation where the lemming syndrome shows up is when relatively evenly matched rivals imitate each other so that they don’t let their competitors gain a differentiated position. If only one had done so, it might concerned the market“ Paul

For instance, Google CEO Sundar Pichai stated during an earnings call, “The risk of underinvesting is dramatically greater than the risk of overinvesting,” a sentiment echoed by Meta CEO Mark Zuckerberg. It's likely we’ll continue hearing similar remarks from other companies. However, how these massive investments will generate returns—particularly in the short term—remains uncertain.

When will the music stop?

I have no idea, and I believe I’m one of the least qualified person to comment on this. However, the prospect of a new technology that could dramatically reduce the reliance on GPUs or data centers in AI is worth considering.

While it’s tough to predict, I am confident it will eventually happen, driven by the principles of Moore’s Law and the relentless pace of technological advancement. Betting against innovation is rarely a wise move, as history has shown us that technology often improves in leaps and bounds.

If history has something to teach us, we would do well to pay attention. As George Santayana famously said, “Those who cannot remember the past are condemned to repeat it.” This wisdom applies not only to human history but also to technology and innovation.

Conclusion

I will stay true to my principle of buying high-quality companies at fair prices, maintaining rationality, and avoiding emotional decision-making. As Charlie Munger wisely said, "Envy is the worst enemy of an investor." My goal is to remain disciplined, investing within my circle of competence.

That said, it’s never easy to be a contrarian in investing, especially when it means going against the crowd. Staying steadfast in your convictions can be challenging when everyone else seems to be chasing the next big thing.

However, history has shown that true investment success often lies in resisting the herd and focusing on long-term value. It’s a brief message, but I hope it resonates with my readers. Happy Investing!!!

Disclaimer: I might have position in the company mentioned and receive no fees for writing the post. I am not affiliated or have any role with the company. This post is just for educational purpose and it is not an advice to buy or sell the stocks. Invest at your own discretion.

It's a good reminder. It can feel safer in a herd, implicitly making the assumption that others have done the hard thinking or have the insights we lack.

yup